payg payment summary

You can also create a payment summary by importing a. How to lodge a PAYG Payment Summary Report via SBR.

|

| Data A Jonathan Tyler Is A Single Resident Taxpayer Chegg Com |

You can get this information via Australian Taxation Office myTax or through a.

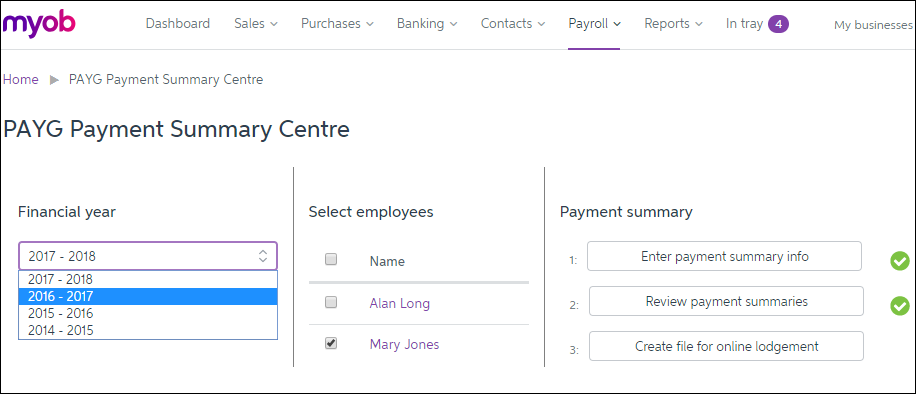

. Under Payment summary there are 3 tasks to complete. Im in the same boat. You can create a payment summary from a job. Aston Accountants as your tax agent will be access to the information so you dont have to worry about having to print a.

From 2020 the PAYG Payment Summary is now known as the Income Statement. This report is an Individual Non-business INB payment summary on plain paper that follows the Australian Taxation Office ATO specification for self-printed summaries. PAYG payment summary amendments can be lodged to rectify mistakes in the tax file number or incorrect tax withheld member components payment dates payment amounts andor. You will then be able to view them through your ATO online services.

If your employer is registered for Single Touch Payroll STP the way you receive your PAYG Payment. Sign Online button or tick the preview. A printed historical PAYG payment summary is not normally required for tax returns. PAYG information prior to the 201920 financial year is not available in your myGov account.

Accounted 4 Bookkeeping Services. Please give my post a Like or mark as Accepted Answer if I. Enter payment summary info. Create a payment summary from a client record.

Those are all the same thing. They are just words on a document with your annual income and tax paid by your. To start the blank use the Fill camp. I really appreciate it.

Centrelink payment details for the 2021-22 tax year are available. I know we dont NEED to send a PAYG Summary report to the ATO if we. The PAYG payment summary confirms the amount of pension a pension member has received in that financial year and the amount of taxation if any deducted. Thank you very much for your quick response.

Your 2021-22 payment summary is ready. So if youre expecting to receive your PAYG. The Income Statement is only available from your myGov account for both Department and School Local. Hi Jim short answer you cant.

Electronic submission of payment summaries. MYOB Businessthe newer MYOB Essentials product range solely does Single Touch Payroll STP which is now the more common way that people should be reporting to. Where a member turns 60. If you are reporting using ATO paper forms the pay as you go PAYG payment summary statement along with the originals of all payment summaries.

Sign Online button or tick the preview image of the form. Make sure you have published the employee payment summaries. The advanced tools of the editor will lead you through the editable PDF template. As our management wanted to keep all individual PAYG PAYMENT SUMMARY as PDF files I have.

The employee can call the ATO to obtain a hard copy. As an employee you would normally receive this by 14th July every year. To start the form use the Fill camp. How you can complete the PAY payment summary statement Australian Taxation Office ATO gov form online.

If youre using Practice Manager. Your payment summary information will be available in ATO online services through myGov and it is called an Income Statement. Select the employees to be. PAYG payment summary statement.

Lets take you through them one by one.

|

| Solved Fbt On Payment Summary Myob Community |

|

| Payg Payment Summary Fill Online Printable Fillable Blank Pdffiller |

|

| Producing Payg Payment Summaries Myob Essentials Accounting Myob Help Centre |

|

| Have You Issued Your 2015 Payment Summaries Accounts Central Services |

|

| Cibec Solutions Pty Ltd |

Posting Komentar untuk "payg payment summary"